How to perform product positioning and 3 case studies that bring it to life

The success of any product hinges on having a quality marketing message that lands the right audience.

Good product positioning helps you excel in both areas. Product positioning is the process of determining the best ways to market and sell a product. It considers user feedback on your product features, the attributes of your target audience, and the characteristics of competing products.

We’ll walk you through how to position any type of product and how other companies have done it. But first, we’ll give you more context on why it’s important.

Why product positioning matters

Why? In the Harvard Business Review, Joan Schneider and Julie Hall explain:

“The biggest problem we’ve encountered is lack of preparation: Companies are so focused on designing and manufacturing new products that they postpone the hard work of getting ready to market them until too late in the game.”

In other words, you need to do your research. The product positioning process forces you to by asking the tough questions that pressure test your messaging and target audience.

Here are just some of the questions you’ll want to get answered:

- Why is our product valuable?

- Which product features are more impactful than others?

- Who finds our product valuable?

- Do particular groups find our product useful for different reasons?

- Who are our top competitors?

- What are our product’s relative strengths and weaknesses?

The insights you receive in each of these areas will give your product the best chance at success.

Not finished building your product?

Learn how to perform concept testing so that you can perfect it!

How to conduct product positioning research

Now that you know why it matters, let’s talk about how you can collect—and use—data that helps you position your product.

Decide how to gather your feedback

Before you gather feedback, carefully consider each of your options.

Run a survey:

Pros

- You can reach a wide range of consumers cost-effectively and quickly.

- Taking the survey can be a small ask for consumers, as they can answer the questions wherever they’d like in a matter of minutes.

- It’s easy to organize and analyze the responses that come in.

Cons

- You won’t be able to gather as in-depth feedback as you would with a focus group or a 1:1 interview.

- You can’t experience people’s reactions in-person.

Need help surveying your target market? Learn how SurveyMonkey Audience can help!

Run a focus group:

Pros

- You’ll be able to gather in-depth feedback.

- You’ll have a chance to gather feedback from several consumers.

Cons

- It can be expensive to organize and gather several individuals.

- You might not be able to recruit consumers from certain backgrounds.

- It can be difficult to hold sessions consistently over time because of logistics or expenses.

Run individual interviews:

Pros

- You can gather more comprehensive feedback than the alternative approaches.

- You can more effectively build trust and credibility with your target audience (as you’re spending more quality time with each of them).

Cons

- It’s the most expensive option out of the 3

- It will be near-impossible to get feedback from a diverse set of consumers.

- It may not be financially sustainable.

Product positioning survey tips

Assuming you decide on using a survey, here are 4 best practices to consider:

1. Organize your questions thoughtfully to ensure you gather quality responses.

Since you’re reaching people who may not be familiar with your product, it can be useful to introduce it at the beginning. For example, use an intro page that includes an image of the product and a few sentences that describe it.

The questions that follow should be ordered by topic. Questions specific to your product should follow each other on a single page; while questions about alternative products should also be grouped together on another page.

For help on the specific questions you can ask, check out our product survey template.

2. Ask your questions to a diverse set of consumers—people of all ages, occupations, and backgrounds. Be especially attentive to any demographics that you want to market to.

3. Analyze your responses carefully so you can arrive at an effective product positioning statement.

Begin by reviewing the responses from your closed-ended questions (those that include answer options—like multiple choice questions). You can build customizable charts to better understand the data and isolate important trends.

Learn more about how you can create charts from your survey responses.

Then review the responses from your open-ended questions (those that don’t include answer options—like comment boxes). You can look at the responses through word clouds to quickly understand how respondents feel about your product, and read through individual responses for more detail.

Finally, make sure to apply Compare Rules. They’ll allow you to group respondents either based on their feedback or their background. You can then compare each group across your questions.

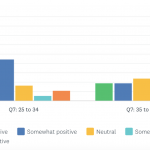

For example, here’s a vertical bar chart that compares two age groups’ responses to the question, “What is your first reaction to the product?”

Once you feel like you understand how different types of consumers feel about your product, you’re ready to start developing a product positioning statement. The statement should concisely explain how your product meets your target audience’s needs—based on your research. Your colleagues in marketing and sales can then use the statement as a reference point for keeping the product’s message on point and for targeting the right people.

To save you time in coming up with your own product positioning statement, you can use the following formula:

For (your audience) who (insert need), (your company) can (insert benefit). And unlike competitors, (your company) can (insert competitive differentiation).

4. Don’t let the product positioning process end.

Your target audience’s needs and perceptions will change over time. To keep up, your product positioning strategy should include an annual round of product feedback.

Note: You may need to collect feedback bi-annually if there have been significant changes to your product and its impact on your target audience.

This is one of the reasons why surveys are a great option for running product positioning studies. They can automatically go out at particular time intervals, offer the flexibility of gathering feedback quickly and affordably, and allow you to easily compare the responses from previous studies.

Product positioning examples

So what does product positioning actually look like? Here are 3 real-world product positioning examples you can learn from:

1. Tesla isn’t the first company to manufacture electric vehicles, but they’ve found success by marketing to environmentally-conscious, middle-to-high income households who value a car’s aesthetics and driving capabilities.

2. Simple offers offers banking services through its clean, simple, and intuitive app. To stand out, they’ve targeted busy young professionals who don’t usually want to visit a bank in-person or deal with a poorly designed site or app.

3. Dollar Shave Club mails customers a variety of shower and shaving supplies on a recurring basis. They differentiate through convenience—customers don’t want to spend time and mental energy on shopping for quality products.

Now that you know how to perform product positioning and have tangible examples to pull from, you’re ready to scope out the ways to market and sell your own products!

Tutustu muihin materiaaleihin

Brändimarkkinoinnin johtaja

Brändimarkkinoinnin johtajat käyttävät näitä työkaluja kohdeyleisön ymmärtämiseen, brändin kasvattamiseen ja sijoitetun pääoman tuoton todistamiseen.

Hornblower parantaa globaalia asiakaskokemusta

Katso miten Hornblower käyttää SurveyMonkeya ja tekoälyä NPS-tiedoista hyötymiseen, asiakasnäkemysten keräämiseen ja asiakaskokemuksen parantamiseen.

Tärkeät tekoälymarkkinoinnin tilastot vuonna 2025

88 % markkinoijista käyttää tekoälyä päivittäin. Katso, kuinka markkinoinnin ammattilaiset käyttävät tekoälyä vuonna 2025 ja kuinka pidät kärkipaikan.

Tutustu SurveyMonkeyn kuluttajatuote- ja ‑palveluratkaisuihin

Kuluttajatuotteiden ja ‑palveluiden toimialalla, kuten matkailussa ja majoituksessa, muokataan tulevaisuutta SurveyMonkeyn avulla.