Näin aloitat markkinatutkimuksen

Markkinatutkimus on tietoon perustuva strategia, joka tarjoaa havaintoja kuluttajista, asenteista ja markkinoista. Näillä ohjeilla voit toteuttaa tehokkaan markkinatutkimuksen.

Markkinatutkimus on dataan perustuva strategia, joka tarjoaa havaintoja kuluttajista, asenteista ja markkinoista. Näillä ohjeilla voit toteuttaa tehokkaan markkinatutkimuksen.

Markkinatutkimus

Markkinatutkimuksessa kerätään tietoa ja havaintoja yrityksen markkinoista, kilpailijoista ja asiakkaista.Tavallisesti organisaatiot tekevät markkinatutkimuksia tuotekehityksen ja markkinointistrategioiden tueksi yrityksen kasvun edistämistä varten.

Tutkimukset auttavat vastaamaan esimerkiksi seuraaviin kysymyksiin:

- Kuinka tuotteemme tai palvelumme mahdollisesti pärjäävät markkinoilla?

- Kuinka brändimme vertautuu kilpailijoihin?

- Mitkä demografiset ryhmät todennäköisesti ostavat tuotettamme tai palveluamme?

- Mitkä mainoskampanjat vetoavat parhaiten kohdemarkkinoihimme?

Nämä tiedot auttavat vastaamaan asiakkaiden tarpeisiin, kasvattamaan voittoa sekä lanseeraamaan tuotteita.

Aiheeseen liittyvää: Markkinatutkimuksen määritelmä ja käyttö

Markkinatutkimuksen merkitys ja edut

Markkinatutkimus antaa dataan perustuvaa näyttöä, jonka avulla yritykset voivat tehdä päätöksiä luottavaisin mielin. Asiakkaiden mieltymykset kannattaa selvittää, sillä yrityksiä ei voi luotsata ainoastaan mututuntumalla.

Tämän vuoksi markkinatutkimus on tärkeää:

- Saat käsityksen kilpailijoista. Markkinatutkimus auttaa selvittämään kilpailijoiden menestyksen mittarit, strategiavajeet ja suuntaukset. Näiden tietojen avulla yrityksesi voi luoda tehokkaita kampanjoita erottuakseen kilpailijoista, parantaakseen asiointia ja voittaakseen asiakkaita.

- Voit luoda parempia tuotteita ja palveluita.Markkinatutkimuksilla yritykset voivat kerätä asiakkaista dataa, kuten havaintoja asiakkaiden suosimista tuote- ja palveluominaisuuksista. Asiakastyytyväisyyskyselyillä kerätty palaute auttaa parantamaan niin tuotteita ja palveluita kuin asiakastyytyväisyyttä.

- Saat käsityksen asiakkaiden mieltymyksistä sekä markkinoiden suuntauksista. Näin yritykset voivat luoda tehokkaampia markkinointikampanjoita ja innovoida oikealla tavalla.

- Voit hioa markkinointistrategioita. Markkinointistrategioiden ja tuotteiden kehittäminen vaatii aikaa ja rahaa. Siksi markkinatutkimuksella kannattaa kerätä tietoa, jonka perusteella ideoita voidaan hyväksyä tai hylätä.

- Voit lujittaa uskottavuutta. Käyttötarkoituksesta riippumatta markkinatutkimus antaa vankkaa tietoa väittämien tueksi.

Markkinatutkimuksen tyypit

Markkinatutkimusta voi tehdä useilla eri tavoilla.Tutustumme nyt yleisimpiin markkinatutkimustyyppeihin, niiden hyviin ja huonoihin puoliin sekä käyttötapoihin.

Selvitämme esimerkiksi seuraavien väliset erot:

- ensisijainen vs.toissijainen tutkimus

- määrällinen vs.laadullinen tutkimus

- omatoiminen vs. täyden palvelun markkinatutkimus.

Aiheeseen liittyvää: Markkinatutkimuksen määritelmä: tyypit ja esimerkkejä

Ensisijainen vs. toissijainen tutkimus

Markkinatutkimus voidaan jakaa kahteen pääkategoriaan: ensisijaiseen ja toissijaiseen tutkimukseen.

| Ensisijainen tutkimus | Toissijainen tutkimus | |

| Määritelmä | Ensisijaisessa markkinatutkimuksessa kerätään alkuperäistä dataa, joka vastaa tiettyyn tutkimuskysymykseen. | Toissijaisessa markkinatutkimuksessa kysymykseen vastataan analysoimalla muiden aiemmin keräämää ja julkaisemaa dataa. |

| Käyttöesimerkki | Ensisijainen tutkimus on avuksi, kun yritys ei todennäköisesti löydä julkaistua dataa tutkimuskysymykseensä. Näin on erityisesti silloin, kun yritys tutkii omia tuotteitaan ja palveluitaan. | Toissijainen tutkimus puolestaan auttaa yrityksiä toteuttamaan ylätason tutkimusta aiemmin tutkitusta aiheesta. Laaja-alaisiin tutkimuskysymyksiin löytyy tavallisesti aiemmin julkaistuja vastauksia. |

| Esimerkki | Yritys haluaa selvittää, kuinka visuaalisesti houkutteleva sen uusi tuote on,ja tutkii asiaa toteuttamalla markkinointikyselytutkimuksen. | Yritys haluaa tietää, mikä demografinen ryhmä tyypillisesti hakee tietoa henkilöasiakkaiden rahoituspalveluista,ja tutustuu rahoituslaitosten aiemmin julkaisemaan dataan. |

| Edut | • Saat suoraan vastauksen tutkimuskysymykseen. • Voit itse hallita tutkimusmenetelmiä. • Voit pureutua syvemmälle aiheeseen esittämällä jatkokysymyksiä. | • Saat dataa käyttöösi välittömästi. • Data on usein ilmaista. • Voit saada välittömästi kontekstia ennen oman tutkimuksen toteuttamista. |

| Haitat | • Tutkimuksen toteuttaminen vie aikaa. • Rajalliset otoskoot voivat aiheuttaa vastausvinoumia. • Inhimilliset virheet voivat vaikuttaa tuloksiin. | • Data voi olla vanhentunutta. • Yrityksesi ei voi vaikuttaa tutkimukseen, jossa voi olla vastausvinoumia tai virheitä. • Et ehkä saa suoraa pääsyä dataan. |

Aiheeseen liittyvää: Ensisijaisen tutkimuksen tyyppejä ja esimerkkejä

Määrällinen vs. laadullinen tutkimus

Määrällinen ja laadullinen tutkimus ovat saman kolikon kaksi puolta. Siinä missä edellinen selvittää luvun, kuten organisaation tyytyväisten työntekijöiden määrän, jälkimmäinen selvittää kyseiseen tulokseen johtaneet syyt.

| Määrällinen tutkimus | Laadullinen tutkimus | |

| Määritelmä | Määrällisessä tutkimuksessa käytetään numeerista dataa sekä numeerisia tuloksia tuottavia tilastollisia analyysejä. | Laadullisessa tutkimuksessa pyritään selvittämään vaikuttimet, tuntemukset, ajatukset ja mielipiteet tiedon taustalla. |

| Käyttöesimerkki | Määrällinen tutkimus auttaa selvittämään kaavoja tai numeerisia tuloksia. | Laadullisesta tutkimuksesta on hyötyä, kun haluat ymmärtää tilastojen taustasyyt pyytämällä tutkimuksessa kommentteja, ideoita ja anekdootteja. |

| Esimerkki | Yritys haluaa tietää, kuinka uskollisia sen työntekijät ovat, ja laskee uskollisten työntekijöiden prosenttiosuuden eNPS-kyselytutkimuksella. | Yritys haluaa tietää, miksi eNPS-tulos oli heikko, ja pyytää kyselytutkimuksilla työntekijöiltä tietoa tyytyväisyystasosta ja työpaikan ongelmista sekä ehdotuksia työntekijäkokemuksen parantamiseksi. |

| Edut | • Objektiivista dataa analyysejä ja vertailua varten. • Yritykset voivat pureutua datasarjoihin yksityiskohtaisesti. • Selkeä kuva tilastojen välisistä suhteista. | • Tarkkaa taustatietoa numeerisesta datasta. • Kontekstia määrälliseen dataan. • Voi auttaa ymmärtämään tilastoihin johtaneet tekijät. |

| Haitat | • Joitakin asioita on hankala mitata määrällisesti. • Lukuja voidaan tulkita väärin. • Harhaanjohtavat kysymykset voivat vääristää tuloksia. | • Data on subjektiivista ja analysointi voi siksi olla hankalaa. • Asenteiden erilaiset tulkinnat voivat vaikeuttaa laadullisen tiedon käsittelyä. • Laadullisen datan tallentaminen ja analysointi on haastavaa. |

Tutkijat voivat toteuttaa määrällistä ja laadullista tutkimusta erikseen tai yhdessä saadakseen laaja-alaisempia ja syvällisempiä havaintoja.

Aiheeseen liittyvää: Määrällisen tutkimuksen tyypit ja käyttökohteet

Omatoiminen vs. täyden palvelun markkinatutkimus

Myös tutkimuksen tekijä kannattaa huomioida tutkimusmenetelmää valittaessa.

| Omatoiminen markkinatutkimus | Täyden palvelun markkinatutkimus | |

| Määritelmä | Omatoiminen markkinatutkimus tarkoittaa, että yritys toteuttaa tutkimuksen itse käyttäen omia voimavarojaan. | Täyden palvelun markkinatutkimuksen toteuttaa sen sijaan yrityksen palkkaama ulkopuolinen tutkimusryhmä. |

| Käyttöesimerkki | Omatoiminen tutkimus sopii yrityksille, joiden budjetti on rajallinen. | Täyden palvelun tutkimuksesta on hyötyä, kun yritys tarvitsee laadukkaan ja monitahoista dataa analysoivan tutkimuksen. |

| Esimerkki | Yritys kerää näkemyksiä lähettämällä kyselytutkimuksen sähköpostitse omille asiakkailleen. | Yritys kerää tuhansittain mielipiteitä uudesta tuotteesta toteuttamalla yksityiskohtaisen tutkimuksen puhelimitse koko maassa. |

| Edut | • Kustannukset ovat matalat. • Voit hallita tutkimuskysymyksiä täysin. • Saat tuloksia nopeasti. | • Korkeat laatustandardit. • Kerätty data on tarkkaa, puolueetonta ja kattavaa. • Pitkälle kehitetyt tutkimusmenetelmät ja suuri tutkittava populaatio. |

| Haitat | • Voi viedä aikaa. • Lähteiden määrä on rajallinen. • Yrityksen sisäisen asiantuntemuksen puute voi vaikuttaa tuloksiin. | • Voi olla kallista. • Vähäinen näkyvyys koko tutkimusprosessiin. • Projektin toteuttaminen voi kestää kuukausia. |

Aiheeseen liittyvää: Näin edistät yrityksen kasvua nopeasti omatoimisella markkinatutkimuksella

Näin teet markkinatutkimuksen tehokkaasti

Markkinatutkimus vaatii kaukokatseisuutta ja valmistautumista. Kun teet suunnitelman etukäteen, osaat käynnistää tutkimuksen, kerätä havaintoja ja muuttaa datan käyttökelpoisiksi toimintavaiheiksi.

Näiden vaiheiden avulla voit toteuttaa markkinatutkimuksen.

1. Aseta tutkimustavoitteet

Markkinatutkimusprojektin luominen alusta asti voi tuntua haastavalta. Kirjoita aluksi liiketoimintakysymys ja saavutettavat tutkimustavoitteet.

Liiketoimintakysymys selittää lyhyesti ratkaistavan ongelman sekä kontekstin liiketoimintaasi nähden. Liiketoimintakysymykset ovat ylätason tavoitteita tai haasteita, ja ne liittyvät suoraan päätöksenteon tukena toimiviin liiketoimintatavoitteisiin.

Liiketoimintakysymyksen aihe voi olla jokin seuraavista:

- Tietämyksen puute: asiat, joita et tiedä toimialastasi, kilpailijoistasi tai ostajapersoonista.

- Yrityksen tapahtumat: yrityksessäsi havaitsemasi suuntaukset (esimerkiksi myynnin lasku tai vaihtuvuuden kasvu), joille on löydettävä selitykset.

- Ennusteet: haluat ehkä olla askeleen edellä kilpailijoitasi.

Tutkimustavoitteessa hahmotellaan ne seikat tai mittarit, jotka haluat selvittää tutkimuksessa. Toisin sanoen tutkimustavoitteet auttavat vastaamaan liiketoimintakysymykseen, ja voit luoda nämä tavoitteet kirjoittamasi kysymyksen perusteella.

Tutkimustavoitteet kannattaa kirjoittaa selkeästi, sillä kyselytutkimuksen kysymykset kirjoitetaan niiden mukaan.

Esimerkkejä markkinatutkimuksen tutkimustavoitteista ja liiketoimintakysymyksistä

Seuraavat hypoteettiset liiketoimintakysymykset ja tutkimustavoitteet auttavat luomaan tehokkaita tutkimustavoitteita.

| Liiketoimintakysymys | Tutkimustavoite |

| Kuluttajien käyttäytyminen: harkitsemme investointia videoiden suoratoistopalveluun ja haluamme siksi selvittää vallitsevan tilanteen ja vallitsevat käsitykset. | • Selvitä, mitä brändejä ja sovelluksia millenniaalit suosivat. • Kerää näyttöä käytettyjen sovellusten määrästä ja käyttäjien tyytyväisyydestä. • Selvitä, kuinka millenniaalit käyttävät suoratoistopalveluja ja kuinka he suhtautuvat niihin. |

| Mainosten testaus: Lanseeraamme pian uuden koiranruoan ja olemme luoneet useita mainosehdotuksia. Kuinka valitsemme parhaan mainoksen? | • Testaa, miten kukin mainos vetoaa kuluttajiin ja mitä mainosta kuluttajat suosivat. • Selvitä, mikä mainos saisi kuluttajat maksamaan enemmän. • Arvioi eroja kuluttajien demografisten tietojen perusteella. |

| Brändin seuranta: Brändimme on vakiinnuttanut asemansa kivennäisvesimarkkinoilla, mutta viime vuoden aikana on lanseerattu useita uusia brändejä. Miten tämä vaikuttaa meihin? | • Mittaa bränditietoisuutta kategorian suurten brändien osalta. • Arvioi kuhunkin brändiin liittyvät käsitykset ja mielleyhtymät. • Selvitä, kuinka kuluttajat ovat omaksuneet niin meidän brändimme kuin uudet tulokkaat. |

Kun olet kirjoittanut liiketoimintakysymyksen ja tutkimustavoitteen, lisää ne tutkimusmuistioon.

Hyvin kirjoitettu tutkimusmuistio kertoo selkeästi tutkittavasta asiasta ja varmistaa, että kaikilla on asiasta sama käsitys.

2. Valitse kohdeyleisö

Markkinatutkimusta toteuttaessa tärkein tavoite on selvittää kohdeyleisön käyttäytymistä ja käsityksiä.

Kun valitset kohdeyleisön ennen markkinatutkimuksen toteuttamista, voit kerätä asianmukaista ja täsmällistä dataa, yksilöidä tutkimuksen, optimoida voimavarat ja luoda tehokkaita strategioita.

Voit määrittää kohdeyleisön esimerkiksi näiden ominaisuuksien perusteella:

- Demografiset tiedot: sijainti, ikä, sukupuoli, koulutustaso, kotitalouden tulot, etninen tausta, siviilisääty, vanhemmuus.

- Työllisyys ja yritystiedot: työtilanne, työtehtävä, työtehtävätaso, toimiala, yrityksen koko.

- Ostotottumukset: kaupat tai ravintolat, joissa on käyty äskettäin, ostotiheys verkkokaupoissa, ostoksen todennäköisyys seuraavien 12 kuukauden aikana.

- Käyttäytymistekijät: mobiililaitteen tai sovelluksen käyttö, lemmikin omistajuus, liikuntatottumukset, ruokavaliorajoitukset, harrastukset.

Se, kenelle markkinatutkimus suunnataan ja kuinka se tehdään, vaikuttaa myös projektin voimavarojen kohdentamiseen.

Selvitä seuraavat seikat ennen kuin aloitat:

- Kenelle markkinatutkimus suunnataan?

- Kuinka monelta ihmiseltä on kerättävä dataa?

- Pystynkö tavoittamaan kyseiset ihmiset?

- Voinko saada heiltä vastauksia tarpeeksi nopeasti?

- Kuinka lähetän kysymykseni heille?

Joskus markkinatutkimus suunnataan laajalle yleisölle ja toisinaan pienille ryhmille.

Aiheeseen liittyvää: Markkinasegmentoinnin viisi tyyppiä ja niiden käyttötavat

Näin tavoitat kohdeyleisösi

Voit tavoittaa kohdeyleisösi kahdella eri tavalla: voit ottaa yhteyttä nykyisiin yhteyshenkilöihin tai valita ryhmän tiettyjen kriteerien perusteella.

Nykyiset yhteyshenkilöt ovat työntekijöitä, verkkosivuston kävijöitä tai sosiaalisen median käyttäjiä, ja voit tavoittaa nämä henkilöt helposti.

Useimmissa tapauksissa yhteydenottoon käy:

- sähköposti

- julkaisu sosiaalisessa mediassa

- verkkosivustolle upotettu kyselytutkimus

- kuittiin tai markkinointimateriaaliin lisätty sivustolinkki tai QR-koodi.

Tietty ryhmä kannattaa pyrkiä tavoittamaan silloin, kun sinulla ei ole suoraa yhteyttä haluamaasi kohdeyleisöön.

Sanotaan vaikka, että tuotteesi on tarkoitettu pienille koirille. Lemmikkien omistajat ovat koko aikuisväestön osajoukko, koiranomistajat ovat lemmikkien omistajien osajoukko ja pienten koirien omistajat ovat koiranomistajien osajoukko.

Tutkimuksen voi kohdentaa rajattuun populaatioon kahdella tavalla: valmiiden profiilien tai seulontakysymysten avulla.

SurveyMonkey Audiencen avulla voit käyttää yli 335 miljoonasta ihmisestä luotuja valmiita profiileja, joissa on kohdennuksen lisävalintoja. Yleisön voi valita esimerkiksi seuraavien kriteerien perusteella:

- Demografiset tiedot: ikä, sukupuoli, kotitalouden tulot jne.

- Yrityksen tiedot: toimiala, työtehtävä, työtehtävätaso jne.

- Käyttäytymistekijät: käytetyt laitteet, ladatut sovellukset jne.

- Ostotottumukset: ensisijaiset ostoksilla kävijät, ostosten tekijöiden suosimat liikkeet jne.

Tutustu tarjoamiimme kohdennusvalintoihin, joita voit käyttää seuraavassa markkinatutkimusprojektissasi.

Voit esittää omia seulontakysymyksiä, kun saatavilla olevat kohdennusvaihtoehdot eivät suodata haluamaasi kohdeyleisöä.

Voit myös käyttää molempia tapoja yhdessä esimerkiksi suodattamalla koiranomistajat kohdennusvalinnoilla ja esittämällä sitten seulontakysymyksiä poistaaksesi joukosta suurten koirien omistajat.

3. Valitse tutkimusmenetelmä

Löydät todennäköisesti 1–2 projektisi tavoitteita vastaavaa tutkimusmenetelmää, tai voit käyttää useita tutkimusmenetelmiä yhdessä.

1. Kyselytutkimukset

Markkinatutkimuskyselyjen suurin etu on, että dataa voi niillä kerätä nopeasti. Yritykset voivat saada runsaasti vastauksia lähettämällä asiakkailleen sähköpostissa kyselytutkimuslinkin.

Puolueellisuuden mahdollisuus tulee kuitenkin ottaa huomioon kyselytutkimusta luotaessa. Muista siis noudattaa parhaita käytäntöjä kirjoittaessasi kyselytutkimuskysymyksiä, niin et johdattele yleisöä vastamaan tietyllä tavalla.

Suljetut kysymykset auttavat tekemään vastauksista tilastollisia analyysejä. Voit myös lisätä kyselytutkimukseen avoimia kysymyksiä saadaksesi aiheesta tarkempaa tietoa.

Kun teet markkinatutkimuksesi SurveyMonkeyssa, saat nopeasti yksilöitäviä ja asiantuntemuksella tehtyjä kyselytutkimuksia.

2. Kohderyhmät

Kohderyhmät ovat samankaltaisten ominaisuuksien perusteella valikoituja pieniä ryhmiä.

Kohderyhmiä kannattaa käyttää yritystä koskevien yksityiskohtaisten mielipiteiden, arvostelujen, kommenttien ja ideoiden keräämiseen. Näin voit pureutua asiakkaiden vaikuttimiin tai selvittää tärkeää tietoa liiketoimintakysymyksen ratkaisemiseksi.

Kohderyhmät eivät kuitenkaan tavallisesti ole tilastollisesti edustavia eivätkä ne tuo markkinoiden monimuotoisuutta riittävästi esiin.

Aiheeseen liittyvää: Asiakas‑ ja markkinatutkimuksen kohderyhmät ja kyselytutkimukset

4. Haastattelut

Markkinatutkimushaastattelut ovat kahdenkeskisiä keskusteluja, joissa asiakkailta kerätään syvällistä laadullista tietoa. Ne eroavat kohderyhmistä siinä, miten tarkasti asioista voidaan kysyä, sillä haastattelijana toimiessasi voit esittää syventäviä jatkokysymyksiä.

Haastatteluja kannattaa käyttää, kun on kerättävä erittäin täsmällistä laadullista dataa. Erityisesti tilanteissa, joissa vastaajat eivät halua avautua ryhmässä, tutkimus kannattaa tehdä haastatteluna.

Suurin haittapuoli on se, että ne voivat viedä hyvin paljon aikaa.

5. Julkinen data

Dataa voi kerätä nopeasti myös hyödyntämällä julkista dataa.

Julkinen data on kustannustehokas ja helposti käytettävissä oleva keino saada dataa markkinatutkimukseen. Erityisesti viranomaisten tai tunnettujen yritysten keräämä data on tavallisesti selkeästi jäsenneltyä, puolueetonta ja täsmällistä, vaikkakaan et voi vaikuttaa sen rakenteeseen.

6. Kilpailija-analyysi

Voit analysoida markkinatutkimuksellasi myös kilpailijoitasi. Voit kerätä yksityiskohtaista tietoa kilpailijoiden palveluista, nykyisistä markkinointikampanjoista ja hinnoista, brändi-imagoista sekä kohdeyleisöistä.

Näin voit saada näkemyksiä toimialasi samankaltaisista yrityksistä sekä löytää tapoja erottua joukosta.

Data ei ehkä kuitenkaan selvennä aihetta riittävästi, mikä voi johtaa virheelliseen kilpailija-analyysiin. Lisäksi datan kerääminen vie aikaa.

Aiheeseen liittyvää: Näin toteutat kilpailuanalyysin kyselytutkimusten avulla

4. Analysoi data

Keräämisen jälkeen data on analysoitava.

Valmistele data

Varmista aluksi, että käytössäsi on täydellinen ja valmis datasarja:

- Aloita analysointi vasta, kun kaikki vastaukset ovat saapuneet. Muista, että kaikki eivät ehkä ole samalla aikavyöhykkeellä.

- Poista huonolaatuiset vastaukset.

- Varmista lopuksi, että otoksesi edustaa kohdepopulaatiota.

Tulkitse tulokset

Saatuasi markkinatutkimuksen tulokset katsot todennäköisesti koko otokselta keräämäsi datan koostettuja vastauksia. Yksittäisiin segmentteihin pureutumalla voit kuitenkin selvittää analyysin kannalta tärkeitä havaintoja.

Näitä otoksen segmenttejä kannattaa katsoa lähemmin:

- Demografiset segmentit: sukupuoli, ikäryhmät jne.

- Maantieteelliset segmentit: maat, alueet, maakunnat jne.

- Käyttäytymistä koskevat segmentit: tiettyjä tuotteita usein ostavat asiakkaat, alennuksia hyödyntävät asiakkaat jne.

Kun olet selvittänyt mielenkiintoiset segmentit, voit poimia tuloksista tarkempia havaintoja segmentoimalla tulokset kahdella tavalla:

- Suodata tulokset: dataa suodattamalla selvität, kuinka laajemman populaation tietty segmentti vastasi kyselytutkimukseesi.

- Vertaa segmenttejä: saat tuloksista enemmän irti, kun vertaat yksittäisiä segmenttejä muihin segmentteihin tai koko datasarjaan.

Analysoi suuntauksia ajan mittaan

Datan kerääminen jatkuvasti voi tuoda suuria etuja yrityksille. Näitä seikkoja kannattaa harkita, kun suuntauksia analysoidaan ajan mittaan:

- Perehdy tilastolliseen merkitsevyyteen: on luonnollista, että vaihtelevista tuloksista pyritään heti vetämään johtopäätöksiä, mutta ennen strategisten päätösten tekemistä on muistettava tarkistaa, että kyseiset erot ovat tilastollisesti merkitseviä.

- Toimi johdonmukaisesti: käytä samoja kohdennuskriteereitä, tasapainotusvalintoja ja muita määrityksiä kerta toisensa jälkeen.

- Käytä samoja ajanjaksoja: jos kyselytutkimusta toteutetaan jatkuvasti, muista jakaa ajanjaksot yhdenmukaisesti esimerkiksi kuukausien, neljännesvuosien tai vuosien mukaan.

5. Esittele tulokset

Teet hyvän vaikutuksen ja kiinnität sidosryhmien huomion parhaiten, kun kerrot selkeän ja loogisen tarinan datan pohjalta.

Muista nämä seikat tarinaa luodessasi:

1. Luonnostele tarina

Vaikka tunnet nyt itse tutkimuksesi läpikotaisin, se on vielä uusi asia monelle kuulijalle.

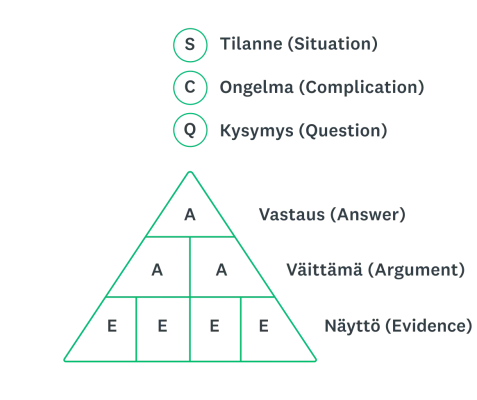

Esitelmän hahmottelemisessa auttaa sopiva runko, jonka perusteella voit kertoa tarinan. Runkona voi toimia esimerkiksi SCQA-malli, jossa käsitellään tilannetta, ongelmaa, kysymystä ja vastausta (englanniksi Situation, Complication, Question ja Answer).

- Tilanne: yrityksen nykytilanne, tunnetut tekijät ja muut asiaan liittyvät seikat.

- Ongelma: ratkaisua vaativa yrityksen ongelma, eli syy markkinatutkimuksen tekemiseen.

- Kysymys: tutkimuksessa vastattavat kysymykset sekä keinot vastausten saamiseksi.

- Vastaus: tärkeimmät markkinatutkimuksesta saatavat havainnot, jotka vastaavat liiketoimintakysymykseen ja auttavat ratkaisemaan ongelman.

2. Lisää mukaan liiketoiminnan konteksti

Kerro liiketoiminnan kontekstista esitelmöidessäsi tutkimuksesta, niin tutkimuksen tarpeellisuus avautuu kuulijoille. Kun seuraat edellä annettua mallia, tämä sisältyy tarinassa esitettyyn ongelmaan.

Havainnollista, miksi tutkimuksella on merkitystä, miksi sidosryhmien tulisi paneutua asiaan ja miten tulokset voivat auttaa yritystä.

3. Valitse tehokkaita tilastoja

Kiinnitä yleisön huomio vaikuttavimmilla tilastotiedoilla.

Jos tarinaasi parhaiten tukeva data ei ole kovin mielenkiintoista, yritä esittää se eri tavalla. ”10 % amerikkalaisista tuntisi olonsa turvalliseksi matkustaessaan itseohjautuvassa autossa” ei ehkä herätä yleisön huomiota samalla tavalla kuin ”90 % amerikkalaisista ei tuntisi oloaan turvalliseksi”.

4. Painota syytä

Objektiiviset luvut kertovat tapahtumista, mutta kuluttajien henkilökohtaiset kertomukset ja mielipiteet selkeyttävät tapahtumien syitä.

Varmista, että esitelmäsi käsittelee sekä tapahtumia että niiden syitä.

5. Esitä asiat selkeästi

Vaikka olisit saanut tutkimuksesta runsaasti dataa, kaikki kiinnostavat tulokset eivät ehkä kuitenkaan liity tarinaasi. Ota mukaan vain tulokset, jotka edistävät tarinaasi ja auttavat antamaan suosituksia, ja jaa muut tulokset liitteessä.

6. Valitse oikea tapa esittää tulokset

SurveyMonkeyn tutkimuksen mukaan 42 % ihmisistä haluaa nähdä datan mieluummin käyrien, kaavioiden tai infografiikan muodossa kuin tekstiksi kirjoitettuna tai taulukoissa.

Nämä ovat yleisimmät kaaviotyypit:

7. Keskity ihmisiin

Markkinatutkimuksen perimmäinen tavoite on tuoda esiin ihmisten käsityksiä ja käyttäytymismalleja. Mitä enemmän todellisia esimerkkejä tarinassasi on, sitä aidommilta tulokset tuntuvat.

Voit vaikkapa lisätä tarinaan suoria lainauksia avointen kysymysten vastauksista tai yhdistää määrällisiin tuloksiin laadullista tietoa, kuten haastatteluja ja esimerkkejä asiakastuesta. Näin saat dataan eloa ja vetoat kuulijoihin syvällisemmin.

6. Inspiroi toimintaan

Seuraavat strategiat toimivat hyvin, kun haluat kehottaa sidosryhmiä toimimaan:

- Järjestä kokouksia: esittele tulokset ja suositukset tärkeimpien sidosryhmien edustajille.

- Luo jatkosuunnitelma: varmista sidosryhmien vastuuvelvollisuus seurantakokousten ja yksityiskohtaisten projektisuunnitelmien avulla.

Voitat sidosryhmät puolellesi, kun suosituksesi ovat realistisia ja linjassa yrityksen liiketoimintastrategian kanssa.

- Asianmukainen: Lue tutkimusmuistio uudelleen ja varmista, että suositukset perustuvat alkuperäiseen liiketoimintakysymykseen ja saamasi havainnot tukevat niitä.

- Täsmällinen: varmista, että suositukset kertovat toteutettavat toimenpiteet selkeästi.

- Saavutettavissa oleva: ilmaise suunnitelman toteuttamiskelpoisuus kertomalla, mitä suositusten saavuttamiseen tarvitaan, kuten budjetin suuruus tai henkilöstön määrä.

- Mitattava: sido suositukset mitattaviin liiketoimintatuloksiin tai tee ennuste suositusten vaikutuksista liiketoimintaan.

Tee tehokasta markkinatutkimusta SurveyMonkeyn avulla

Arvailujen sijasta voit käyttää dataan perustuvia toimintoja, jotka vievät liiketoimintasi uudelle tasolle.

SurveyMonkey tarjoaa kattavaa tukea ja hallinnoituja markkinatutkimusratkaisuja. Riippumatta siitä, lähetätkö markkinatutkimuskyselyjä vai käytätkö maailmanlaajuista SurveyMonkey Audience ‑kyselytutkimuspaneeliamme, saat meiltä ratkaisun.

Oletko valmis aloittamaan markkinatutkimuksen?

Tutustu muihin materiaaleihin

Brändimarkkinoinnin johtaja

Brändimarkkinoinnin johtajat käyttävät näitä työkaluja kohdeyleisön ymmärtämiseen, brändin kasvattamiseen ja sijoitetun pääoman tuoton todistamiseen.

Tärkeät tekoälymarkkinoinnin tilastot vuonna 2025

88 % markkinoijista käyttää tekoälyä päivittäin. Katso, kuinka markkinoinnin ammattilaiset käyttävät tekoälyä vuonna 2025 ja kuinka pidät kärkipaikan.

Tutustu SurveyMonkeyn kuluttajatuote- ja ‑palveluratkaisuihin

Kuluttajatuotteiden ja ‑palveluiden toimialalla, kuten matkailussa ja majoituksessa, muokataan tulevaisuutta SurveyMonkeyn avulla.

Tutustu SurveyMonkeyn vähittäismyyjille suunnattuihin ratkaisuihin

Katso, miten SurveyMonkey auttaa vähittäismyyntiyrityksiä selvittämään muuttuvia markkinatrendejä, kehittämään ilahduttavia tuotteita ja rakentamaan suosittuja brändejä.